Start your custom printing business today!

All successful businesses expand. But with that desirable growth comes the reality of international legal compliance. As your orders cross various borders, they will be subject to the value-added taxation of that country.

The purpose of this article is to help merchants understand the recent legislative changes to value-added tax (VAT) in the EU and the tools we’ve presented for the situation.

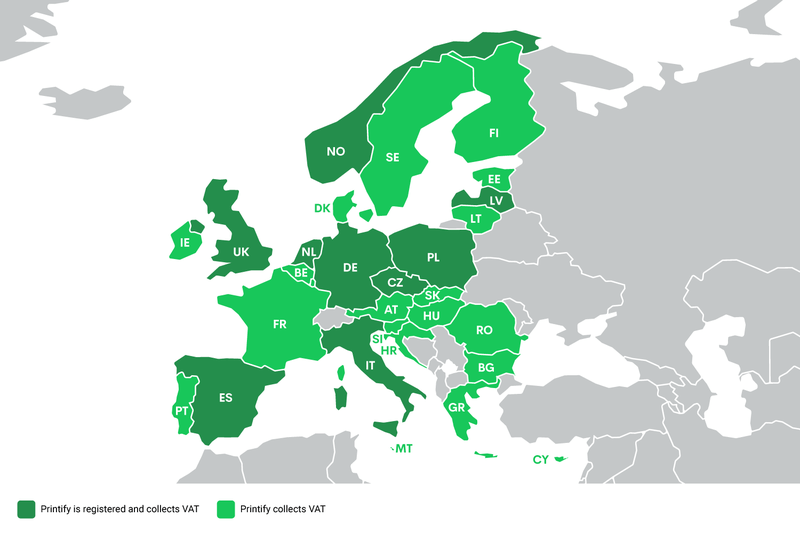

In short, starting October 1, 2021, Printify is charging VAT on orders in the European Union, Norway, and the United Kingdom. At the same time, we’re streamlining legal responsibilities, speeding up order transit, and providing necessary information for merchants to reclaim VAT expenses.

Printify is registered as a VAT payer in Czech Republic, Germany, Italy, Latvia, the Netherlands, Norway, Poland, Spain, and the UK.

Please note that this article is not meant to serve as tax, legal, or accounting advice, instead it has been prepared for informational purposes. We recommend consulting your own tax, legal, and accounting advisors before acting.

Meanwhile, we have partnered with VAT experts to help clarify questions on print-on-demand eCommerce in Europe, and help set up VAT registration and reporting.

1. What is VAT?

These are regulatory measures applied on transactions, tilted toward balancing the global economy. These tariffs also generate income streams for publicly beneficial purposes.

A value-added tax is a transactional tax charged on the sale of goods and services – often between 5-27% of an order’s total cost. This system has been adopted by over 115 countries, providing a common framework for invoicing, registration, and other aspects of international business.

As this tax is applicable at each stage of an order’s production, it is applied relative to the net value of the value of goods sold within producing countries – taking into account local tax rates. Generally speaking, all goods and services moving across borders or sold locally are subject to VAT.

All products within the Printify catalog are subject to VAT. This includes sample orders and items purchased without the intention of resale.

2. How is VAT different from USA sales tax?

VAT and sales tax are really just different sides of the same regulative coin in different parts of the world.

In America, sales tax is primarily applied to the sale of goods. However, these measures are distributed unequally by state and local governing bodies with significant degrees of immunity for various parties. Read more about Printify and US sales tax on our blog here.

In contrast, originally invented in Europe, VAT is almost universally applied to all goods and services.

3. Are VAT rates equal in all European Union jurisdictions?

No. VAT rates are different between each country. However, the VAT rules are harmonized under the European Directive. For more information, please see EU VAT regulations.

4. How is VAT calculated and charged?

The answer to this question depends on what country the order is created in, where it is shipped to, and the VAT ID used in that transaction. Concrete examples are provided at the end of this article, but let’s break down the factors first:

● How is VAT applied to orders that travel within the European Union?

As your goods will undoubtedly cross borders within the EU, the various tax rates applied to orders depend on a few factors, such as whether or not you have a VAT ID, and the order origin and destination countries.

If you can provide a VAT ID within the producing country (where the order originates from), then the VAT of that country will be used.

If you do not have a VAT ID, then the VAT of the destination country (where the order arrives) will be used.

If you have a VAT ID in any other EU country, 0% VAT will be applied. Note that in this case you are responsible to account for the reverse charge mechanism in the destination country.

● How is VAT applied to orders shipped to European Union countries from other locations (USA, China, Etc.)?

This information also applies to The United Kingdom and Norway.

Whenever a foreign order is shipped into the EU (or the UK or NO), a destination VAT is applied. However, Printify will manage all the formalities of customs using our import-one-stop-shop (IOSS) registration, which enables Printify to act as a goods importer.

Before implementing this system, each merchant’s order would be held in customs while their VAT taxes were collected. However, the IOSS regime allows us to charge the VAT upfront if the intrinsic goods’ value of the order is below 150 euros (or equivalent if invoiced in a different currency) and the merchant is not VAT registered in the EU. The VAT charged is then remitted to the tax authority by Printify, saving your customers from legislative challenges and the unpleasant surprise of paying VAT when receiving their order. Needless to say, this allows your customer to receive their order much faster.

This system eases tax burdens, speeds fulfillment, and simplifies legal requirements for all merchants. Here, the local VAT rates of the consumer destination are used.

● How is VAT applied to orders created in Europe and shipped outside of Europe?

When selling goods or services to customers outside the EU, you don’t have to charge customers any VAT.

● How has Brexit affected VAT in the United Kingdom?

All goods shipped into the UK from other countries are subject to their importation rules. When Printify clears merchant orders through customs, those shipments will incur a VAT.

All products produced in the UK and shipped abroad are subject to export rules and further importation processes abroad.

5. What are the one-stop-shop (OSS) And import-one-stop-shop (IOSS) Systems?

Print-on-demand merchants constantly move orders across borders. Before OSS and IOSS, it was necessary to manage several legal processes within each country an order traveled between. But with the introduction of OSS and IOSS systems in July 2021, everything is streamlined by a single (one-stop) registration, avoiding a lot of paperwork.

6. Do I have to charge VAT to my customers?

Generally speaking, goods and services moving are subject to some form of taxation – particularly when crossing borders. So, when one of your orders travels, it will likely incur some form of VAT (in the EU), sales tax (in America), or other tariffs. Things can become much easier to manage under the OSS or IOSS systems.

Keep in mind that all goods on Printify catalog are taxable in Europe. If you have questions about your registration obligations, we suggest you consult a tax advisor.

7. How to prepare for VAT collection on Printify?

The whole process can be broken into four stages:

- Submit your VAT ID(s) on your Printify account – here’s our Help Center article on how to do it,

- The VAT on your orders will be charged based on your provided VAT ID,

- On a regular basis, receive and review your VAT invoices from Printify orders,

- Submit the necessary documentation to tax authorities and include your VAT invoices to reclaim your tax returns.

8. How to set up VAT collection on my sales platform?

9. Examples of VAT calculation

We know that taxation in general is a complex subject. To help you better understand it, we have prepared a table containing the main principles of tax calculation in Europe along with some illustrative examples.

Keep in mind that there are three main variables dictating which VAT rate will be applied to a specific order: ship-from country (print provider’s location), ship-to country (your customer’s location), and your VAT ID (country where you have registered for VAT collection purposes).

| Ship-from → Ship-to | Are you registered for VAT in Europe? | VAT rate | Example |

|---|---|---|---|

| EU → EU | ✅ Yes You have the ship-from country VAT ID | Ship-from country rate | T-shirt, USD 10, DE → IE. DE 19% VAT is charged. Merchant pays USD 11.90 and can claim back VAT USD 1.90 in DE. Final cost is USD 10. |

| EU → EU | ✅ Yes You have any other EU country VAT ID | 0% VAT rate | T-shirt, USD 10, DE → IE. 0% VAT is charged. Merchant pays USD 10. Final cost is USD 10. |

| EU → EU | ❌ No | Ship-to country rate | T-shirt, USD 10, DE → IE. IE 23% VAT is charged. Merchant pays USD 12.30. Final cost is USD 12.30. |

| EU → EU (within the same country) | ➖ Irrelevant | Ship-to country rate | T-shirt, USD 10, DE → DE. DE 19% VAT is charged. Merchant pays USD 11.90. If registered in DE, can claim back VAT USD 1.90 in DE and final cost is USD 10. If not registered in DE, final cost is USD 11.90. |

| Rest of the world → EU | ➖ Irrelevant | Ship-to country rate | T-shirt, USD 10, US → IE. IE VAT 23% is charged. Merchant pays USD 12.30. |

| Any country → the UK | ➖ Irrelevant | Ship-to country rate | T-shirt, USD 10, PL → UK. UK VAT 20% is charged. Merchant pays USD 12.00. |

| Any country → Norway | ➖ Irrelevant | Ship-to country rate | T-shirt, USD 10, PL → NO. Norwegian VAT 25% is charged. Merchant pays USD 12.50. |

Examples are calculated in accordance with value-added tax rates and regulations on August 20, 2021.

10. Where can I get tax advice?

Keep in mind that Printify does not provide legal, tax, or compliance advice. Instead, we strongly encourage you to reach out to licensed tax consultants. Printify merchants will also receive a reduced registration fee, read more here.

We strongly recommend you consult a licensed tax specialist for advice on value-added tax and regulations.