Your business, your way – sell with Printify

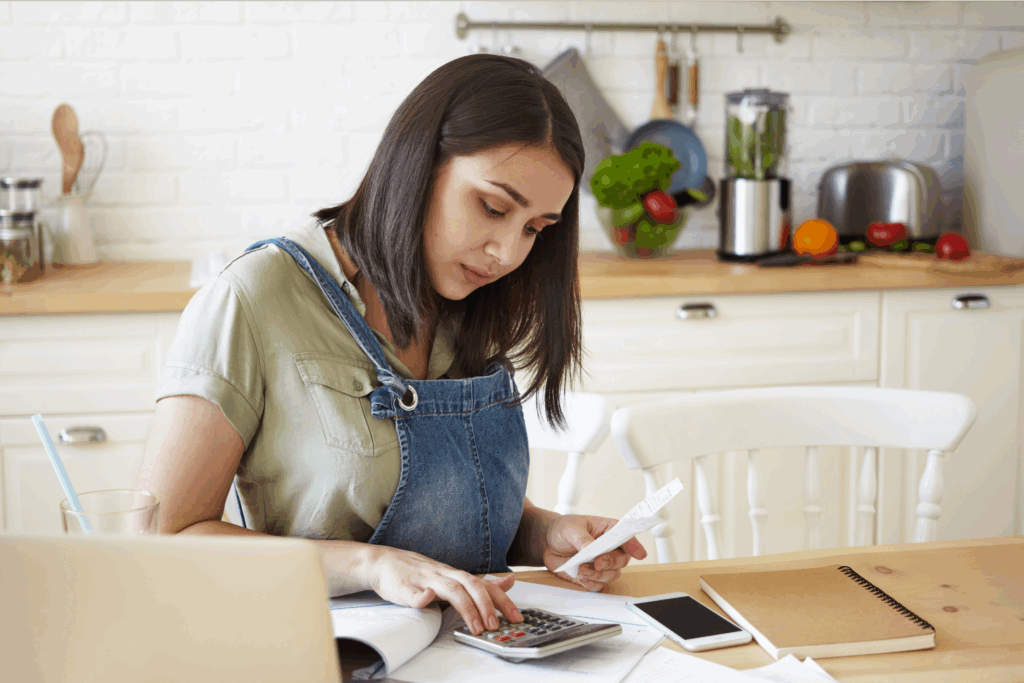

While we are not tax consultants or CPAs, in this article, we try to help you understand sales tax for your business and your peace of mind.

They say the two things guaranteed in life are death and taxes. That is why every year, like clockwork, tax filing finds us and sends us all into a minor panic. But we have good news for you: since October 2020, Printify has been applying sales tax to the states where we are registered to collect. It doesn’t mean you are no longer required to collect taxes in the states you have sales tax nexus, but you don’t have to worry about sales tax compliance in other US-based destinations.

We have also outlined essential information about sales tax in this article. We partnered with the experts at TaxJar for more resources. You will no longer need to waste hours scouring the internet, trying to figure out sales tax. While we recommend a tax expert for specialized sales tax advice, we hope this article gets you one step closer to understand sales tax and closer to some well-deserved peace of mind.

Printify collects sales tax on all taxable products in every state we are registered. Please submit your resale or tax-exemption certificates.

What is sales tax?

A tax is a percentage of the sales price of an item put in place by the government to be remitted whenever the item is sold. The tax collected is then used for public facilities and services such as schools, hospitals, public infrastructure, etc. Sales tax is a percentage collected on retail purchases by the seller and remitted to the state government. Unlike federal taxes, the sales tax is governed by each state, making their laws to collect it, which may differ from one state to another.

Sales tax is also known as the “pass-through tax” because even though a business charges sales tax, they don’t keep it. The business is required to collect it and remit it, “pass it through” to the relevant state government. Sales tax is a consumption tax, which means it is only charged when the end consumer buys goods or services.

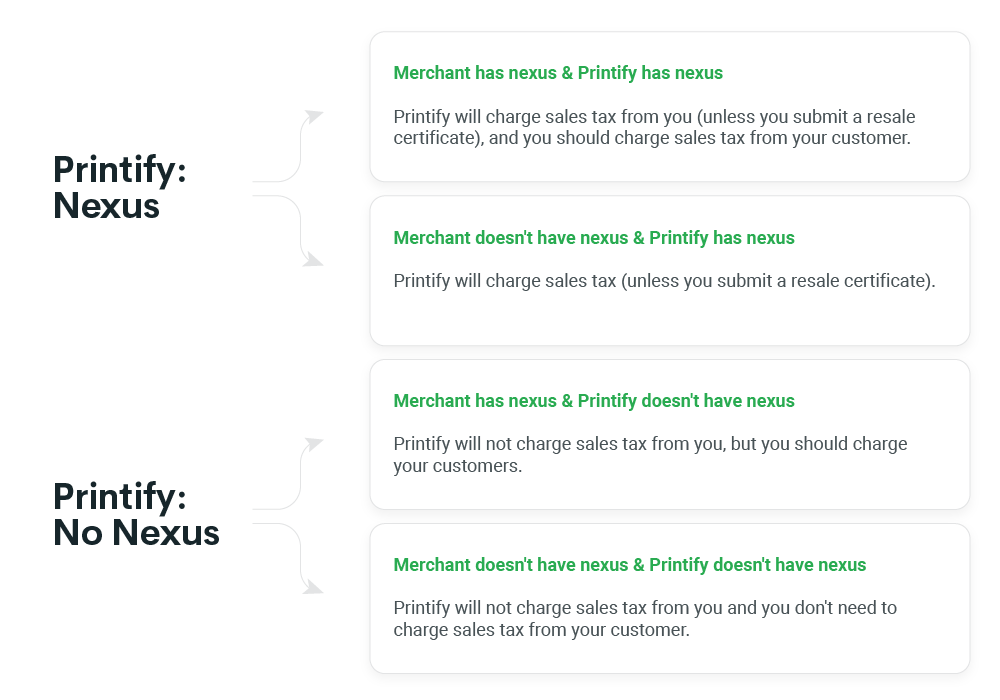

It is important to remember that sales tax is not profitable, it is the law, and getting your business sales tax right is necessary. Sales tax is based on economic and physical nexus in certain states. Nexus rules apply both to Printify selling to merchants, as well as merchants making sales to the final consumers*.

The POD platform business model operates through two distinct transactions. The first transaction occurs between Printify and the merchant, where we sell the ordered products to the merchant. The second transaction takes place when the merchant sells products to their customers, and it becomes their responsibility to handle taxes based on their nexus and other applicable requirements. In the United States, the place of taxation is determined by the location of the purchase, specifically the states where the merchant’s customers are located and where the products are delivered.

How do you qualify for sales tax?

Nexus

What is a sales tax nexus? This is when you have a physical presence or a substantial connection to a state that requires you to comply with their tax laws. You need to collect sales tax from sales in a state where you have sales tax nexus.

How do you get nexus with a state?

You may acquire sales tax nexus if you qualify for any of these four factors:

- Physical presence: Your location may create a sales tax nexus. This includes formal and informal retail premises such as a brick-and-mortar store, an office, a home office, a garage, or even your kitchen table if you conduct business from there.

- Your business employees: You may create nexus if you have hired professionals, such as salespeople, or social media consultants for your business. This includes employees working remotely, who may be in different states, and create nexus there. In some states, affiliates (indirect services) may also give you sales tax nexus.

- Your business warehouse/storage: Where you store your inventory may also give you nexus. This means if most of your inventory is stored by your Print Provider in a particular state, such as California, you may have nexus in the state. Note that Print on Demand from a Print Provider’s fulfillment center does not give you nexus.

- Economic nexus: If you make enough sales in dollars or transactions that meet the requirements of a particular state, you may have economic nexus in that state. The tricky part about economic nexus is that it is determined by individual states and may differ from one state to another. Economic nexus is the primary reason Printify is required to collect sales tax.

The South Dakota vs. Wayfair Case of 2018

Regulations within a state’s Economic nexus changed drastically on June 21, 2018, following the South Dakota vs. Wayfair case. The United States Supreme Court overturned a previous court decision and law known as Quill, which established that the state government could only tax businesses with a “physical presence” in that state. Now states can tax remote sellers if they make enough sales in dollars or transactions that cross their economic thresholds. This was designed to level the playing field between brick and mortar (physical) businesses and eCommerce stores so that both have to pay taxes.

The Wayfair ruling of 2018 was groundbreaking for the print-on-demand and dropshipping industry. Since then, many online sellers have struggled to understand what states they are eligible for sales tax and where they are required to comply and remit. Therefore, we suggest you read about dropshipping and sales tax in the post-Wayfair era.

Selling taxable items

Generally, sales tax is charged by most states within the US, in exception of very few, namely, Delaware, Montana, New Hampshire, and Oregon, though some local areas within these states may be able to charge a sales tax. While many states put a sales tax on clothing, some have legislated clothing as a basic need and it is either entirely non-taxable or only taxable when priced at above a certain threshold. Our collaborators TaxJar created a helpful article with a visual representation to check which states are tax-exempt or apply sales tax on clothing. Moreover, please note that sales tax can also apply to shipping rates depending on the specific state.

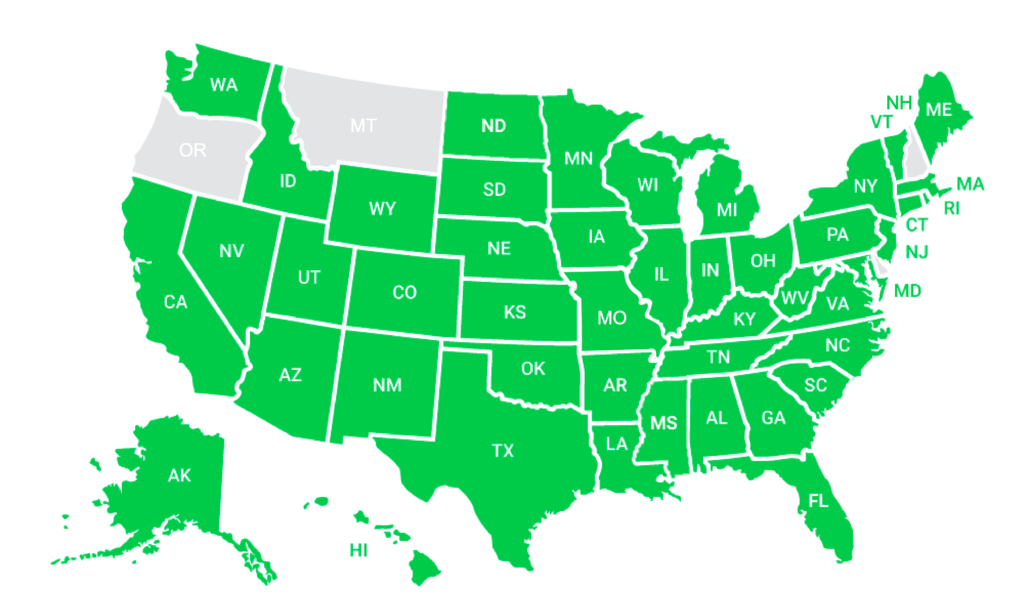

Where is Printify registered to collect and remit sales tax?

Printify is required by law to collect sales tax in states where we have nexus, on sales (including costs associated with shipping) to our merchants. Below is a map showing all the states where Printify is registered for sales tax purposes and therefore collects and remits sales tax. Find additional information on state and local sales taxes.

Starting March 1, 2022, Printify will also begin charging sales tax in Puerto Rico.

How will Printify charge sales tax, and how will it be calculated?

1. Based on your customer’s destination (ZIP code) – Printify uses your customer’s shipping address to calculate sales taxes.

Please note that Printify collects sales taxes for the specific states that we are registered for in the USA, including orders for international sellers where the destination is within the USA.

2. Based on orders coming in from specific sales channels or API – Printify calculates and collects sales taxes based on resale certificates provided by the merchant.

3. For all sample orders – the sales tax is displayed at checkout and collected by Printify. The tax is also based on the resale certificates you, as the seller, have provided.

How to register and collect sales tax?

Register for collecting sales tax (sales permits): You cannot collect sales tax without a sales tax permit. Once you’ve determined that you have nexus with a state, the next step should be to register for a sales tax permit with the state to start collecting sales tax.

US-based merchants

Sellers within the US should consider both their physical and economic nexus and register for sales tax permits where applicable.

International merchants

It is important to note that international sellers may also have sales tax nexus and may be required to register for sales tax permits. If you are outside the US but are selling within the US, you may have nexus and should check as well.

You may benefit from getting a tax expert to help you handle your sales tax requirements*.

How to get a resale certificate after you have registered for collecting sales tax?

Apply for a resale certificate

As a Printify seller, we recommend requesting a resale certificate from state authorities. Alternatively, if you’re already registered for the tax/sales permit in your state/multiple states, preparing MTC or SSTGB certificates on your own following the comprehensive guide we have put together here.

A resale certificate (also known as a sales tax exemption certificate) is different from a sales tax permit as it allows you to buy products without paying sales tax on our end if you plan to resell them and collect the sales tax through your business. This means that Printify will not collect sales tax from you.

Submit your resale certificates to Printify

1. State-specific resale certificate: You are able to submit a resale certificate to Printify for each state that you collect sales tax so that we do not receive it from you. Your resale certificate will go under review, and, if approved, you will not be charged sales tax on orders shipping to the state that issued the resale certificate. If denied, we’ll let you know why, so you can fix and resubmit it.

2. Uniform sales tax exemption certificate (MTC – Multistate Tax Commission): The MTC is a commission that has developed a uniform resale certificate that is acceptable for use as a “blanket” resale certificate in 38 states in the USA for sales tax purposes. This means that by using the MTC, you can claim a resale exemption for multiple states. The certificate itself contains instructions on its use. It includes a list of all the states that have indicated to the Commission that an adequately filled form satisfies their requirements for a valid resale certificate. Find out how to apply for the MTC certificate and any specific limitations on its use.

Please submit your resale certificates in your account settings under Indirect Taxes, and our team will review them.

How do I set up sales tax through my sales channel?

Some states in the US have made laws that require online marketplaces to collect and remit sales taxes on behalf of their third-party seller transactions. This means any sales you make via these marketplaces will be taxed for you automatically. Unless you have nexus in these states, you will not be required to do any additional remitting.

However, if you have nexus in these states, you will be required to file a “Zero tax return” or register for a non-reporting sales tax status. Additionally, it is advisable to keep a sales tax permit in states where you have nexus as the marketplaces only remit the taxes for sales made through the marketplace. We advise that you reach out to sales channel representatives or tax consultants for the appropriate information and setup.

Marketplaces as sales tax facilitators

Etsy and eBay are registered as marketplace facilitators in the majority of states and are required to collect and remit sales taxes on behalf of their merchants. To avoid double-taxing, orders carried out through our direct integrations with Etsy and eBay will be exempt from sales tax charges. Before going further with your sales channel options, see if you need a business license to sell on Etsy.

How to file a return for sales tax

If you are registered for sales tax purposes and collect sales tax, you are required to file a return that indicates how much sales tax you have collected and remitted. Follow the guidelines on the TaxJar map to file a return for each state. TaxJar connects all marketplaces you sell and then creates return-ready tax reports in the manner in which a state wants to receive it. If you are tax registered, you are required to file a sales tax return whenever you have a filing due, even if you did not collect any sales tax to avoid penalties.

So, what should you do about the sales taxes?

Now, when you hopefully understand the theoretical part about sales tax a bit better, what does it all mean in practice, and what should be your next steps?

- Check if/where you have a sales tax nexus.

- If you have nexus, we recommend consulting a sales tax advisor but the steps will most likely include:

- Choosing and setting up a tool for tax calculation and collection;

- Applying for a sales tax permit for each state you have nexus in;

- Submitting a resale certificate for each state you charge sales tax in – to purchase products without paying sales tax if you plan to resell them. This means that Printify won’t charge sales tax in those states;

- If you collect taxes, you will also need to report and remit them, thus, use your chosen tool for tax reporting and follow their guidelines.

- If you don’t have nexus and haven’t uploaded a valid resale certificate, Printify will charge sales tax on your item and shipping cost for orders shipped to states where Printify is registered. No other actions needed.

In case you use Etsy as your sales channel, please refer to the specific information mentioned above.

Examples for tax calculation

To make sales tax easier to digest, we have prepared a few examples of tax calculations depending on the product category, sales channel, merchant documentation, and order destination.

Examples are calculated in accordance with sales tax rates and regulations on August 18, 2020.

For easy comparison, we picked examples of orders with a single item going for the same cost at $20 and shipping cost at $10.

All sales tax calculations are performed by licensed tax automation software that considers all relevant information and state-specific rates and exemptions. Please, note that for orders going to California, the sales tax is calculated based on the final retail price, not item cost.

Where can I get sales tax advice?

We at Printify are not tax experts or specialists and cannot give you any tax or legal advice. We strongly recommend you consult a tax specialist or CPA to get information on sales tax and regulations. That is why we have partnered with the specialists at TaxJar:

TaxJar is a leading technology for eCommerce businesses to manage sales tax. TaxJar features tools that make eCommerce easier for everyone by helping merchants spend time on their business and not sales tax.

- All of your sales tax data in one place: TaxJar instantly prepares your state return-ready reports from all of the places you sell, with one-click integrations with the top platforms, services, and marketplaces. See it all in one place.

- Seamless and automatic filing: With AutoFile, your tax forms will be automatically submitted when they are due. Never miss a deadline again.

- Real-time sales tax rates and calculations: Upgrade to TaxJar Professional, and the TaxJar API will instantly provide accurate sales tax rates at checkout.

If you would like to learn more in-depth information on sales tax, here’s an Online Seller’s Guide to eCommerce Sales Tax.

We strongly recommend you consult a tax specialist or CPA to get advice on sales tax and regulations.