Sell custom products with Printify

When setting up an Etsy shop, sellers have the entrepreneurial freedom to participate in the growth of eCommerce and make a profit. However, this also means dealing with taxable income, business expenses, and Etsy fees, impacting the net profit of your Etsy business.

To help you navigate through the legal scrutiny of the IRS, this article will list all appreciable Etsy taxes and ways to retain and save money from expenses. Learn all the fundamentals and free up time to optimize your storefront and connect with customers.

This article is for informational purposes only and does not constitute legal, tax, or financial advice. Please consult a qualified tax professional or accountant for advice specific to your situation and ensure compliance with all applicable tax laws and regulations.

What taxes do Etsy sellers need to file?

Once you start selling on Etsy and making a profit, your store qualifies as a business and has to comply with national tax laws and regulations.

If you don’t intend to profit, your Etsy store might qualify as hobby income and is not taxable.

Every Etsy seller working as a business is subject to the following taxes:

Self-employment taxes

Any individual on Etsy who works as a sole proprietor – is not part of a corporation, partnership, or limited liability company – and makes $400 or more in gross sales volume must file a Schedule SE form once a year. Find more information on the IRS government website.

Annual income taxes

Etsy sellers are liable for income taxes to the federal government. These taxes are progressive, meaning that their amount depends on your taxable income level and where you live. The calculation also considers tax-deductible expenses as part of your annual gross income.

Quarterly estimated taxes

Etsy businesses that expect over $1,000 in gross sales income must pay quarterly taxes. You can either use the taxable income you made in the previous year or determine estimated tax payments by deducting business expenses from the expected annual gross income.

Submit a quarterly payment through the IRS website using form 1040-ES. The tax season for quarterly taxes is paid in four annual cycles and is due on the following dates:

- January 1 – March 31. The due date is April 15.

- April 1 – May 31. The due date is June 15.

- June 1 – August 31. The due date is September 15.

- September 1 – December 31. The due date is January 15.

State income taxes

The majority of US states require individuals to pay a state income tax on business profits. This is also applicable to online businesses. Tax rates vary state-by-state – research your local state website for further information on the requirements to pay state income taxes.

Sales tax

Sales tax laws are governed by each individual state’s sales tax jurisdiction. Etsy automatically remits sales taxes on physical goods, as well as digital downloads, to most applicable states.

Tips for tracking your business expenses and claiming tax deductions

Having an accurate view of all your business expenses will help you budget essential business costs and lower the total sum needed to pay income taxes. However, the IRS requires that business deductions are proven as ordinary and necessary:

Ordinary – expenses that are common and accepted in the specific business industry.

Necessary – expenses that are used for your business to succeed and function properly.

Many of your expenses can qualify as tax deductions, but you’ll need to keep documents that claim them as legitimate, protecting you from audits and tax consequences. Often, an independent business owner uses a business account to track their costs separately.

The IRS considers the following as appropriate proof of a deductible business expense:

- Credit card payments, receipts, and statements

- Account statements and invoices

- Cash register tapes

- Cash slips for cash payments

- Receipts for entertainment, travel, transportation, and gift expenses

- Canceled checks

The costs of running an Etsy business might include the following expenses:

- Home office or studio space

- Inventory expenses

- PayPal and other bank fees

- Listing and advertising fees

- Education and business tools

- Insurance and retirement plans

- Postage and shipping supply costs

Keep records of all business expenses to make filing your taxes easier. Use your deductible estimates to assess and pay taxes for eligible income and self-employment tax forms.

Overview of common tax forms

Let’s take a look at some tax forms any business owner on Etsy should be aware of.

1099-K Form

For independent Etsy sellers in the US, the 1099-K tax form is mandatory if you meet state and federal thresholds. Since Etsy is a third-party payment processor, you should receive a 1099-K on Etsy under your account’s Legal and tax information under Finances.

Form 1040

Also known as the Individual Income Tax Return, form 1040 reports the gross income of a US individual. This form allows you to claim tax-deductible expenses to lower your annual payment. The 1040 form must be completed annually before the standard April 15 tax year deadline.

Schedule C and Schedule C-EZ

Schedule C or Schedule C-EZ forms must be filled out when operating an Etsy store as a business. The Schedule C-EZ form is a simplified version of Schedule C. Prioritize the C-EZ form if store expenses are under $5,000, you’re self-employed without employees, and have no inventory.

Schedule SE, Self-Employment Tax

As mentioned before, the Self-Employment Tax is eligible if your store makes $400 or more in gross Etsy sales income. Remember to subtract deductions and credits from your expected gross income. The Schedule SE form includes coverage for Social Security and Medicare taxes.

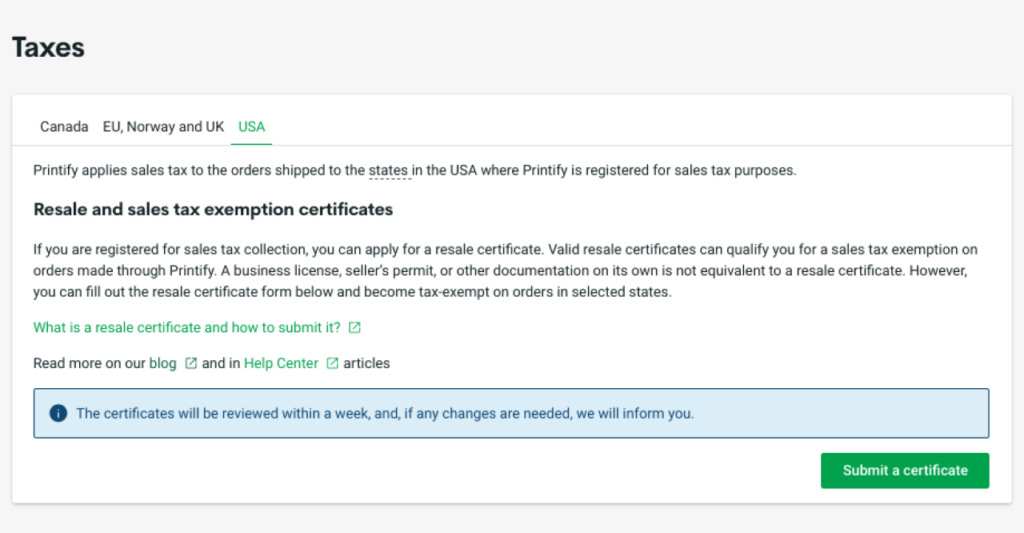

Does Printify collect sales tax?

Etsy is registered as a marketplace facilitator in most states with sales tax requirements. This means that Etsy automatically remits sales tax. To avoid double-taxing, your Etsy income from partnered Printify integrations is exempt from sales tax charges.

Etsy taxes: FAQ

While sellers must pay sales tax on Etsy, the platform’s Etsy Payments system automatically pays sales tax remits. Use your Etsy Seller’s account to view and track all sales tax transactions.

If your independent Etsy business earns $400 or more in profit, you are obligated to start paying self-employment taxes under the Schedule SE form.

Even without a 1099-K form, you still owe taxes from Etsy income to the IRS. For self-employment income and expenses, you can use the 1040-C form, using your own records and Etsy finance info to fill in the required information.

If you’re a shop manager for multiple Etsy stores, the marketplace offers the same combined 1099-K form for each shop you own.

Final thoughts

Etsy is an excellent online marketplace for self-employed people. Etsy Payments sales take transaction fees and sales taxes into account, and the platform provides adequate information and resources for shop managers to pay self-employment tax and file forms in due time.

Make sure to claim expenses to limit overtaxing and follow up on any new net income threshold requirements as your business scales and grows in profit. Pay as you go and research any additional tax advice on official IRS government websites or from a tax expert.