The 2023 eCommerce Statistics Roundup

Get ready for the new year of sales with eCommerce Statistics 2023. The online retail industry has adapted and grown both in sales and revenue, rushing through the global move toward digitization, new operational technologies, and digital commerce strategies.

Explore the global stats, facts, and numbers with Printify – follow as we all collectively continue to shape the world and foster a diverse and competitive online landscape.

Table of Contents

Chapter 1

The State of eCommerce in 2023

Worldwide eCommerce sales continue to grow and won’t stop any time soon. With more people choosing to shop online, revenue has reached new heights despite the global rising costs of living and more price-conscious consumers.

The modern digital boom has created a demand for new innovations in eCommerce. In 2023, more businesses have prioritized moving their sales online, connecting with customers directly, automating the sales cycle, and increasing personalization.

Global eCommerce Statistics

The global community response to the COVID-19 pandemic saw increased growth in eCommerce. While this was initially a way to combat stay-at-home orders, it’s now a deliberate strategy to increase the value and convenience of safe online purchases.

- The global eCommerce market revenue reached $3.09 trillion in 2023, with a continued annual growth rate (CAGR) of 10.06%.

- Total global eCommerce sales account for $6.3 trillion, with a projected 50% increase by 2025.

- The percentage share of global eCommerce sales accounts for nearly 19% of all retail sales worldwide, forecasted to make up close to a quarter by 2027.

- eCommerce sales growth increased to 8.9% in 2023, while traditional retail sales growth fell to 3.9%, reducing the gap in the share of total sales revenue.

- China is the largest eCommerce market segment in terms of revenue, accounting for almost 50% of global online transactions, with North America following close behind.

- Other market segments with significant growth include Latin America and Southeast Asia, expected to grow by 17% and 20% in the next five years.

- 2.64 billion consumers bought products online in 2023, accounting for a staggering one-third of the global population.

- The average eCommerce conversion rate across all online businesses is 2.58%, but it varies significantly depending on the market industry.

eCommerce Statistics in the US

The United States eCommerce market comprises a large portion of global eCommerce revenue, in no small part due to eCommerce giants like Amazon. An increasing number of online users have adapted to eCommerce from brick-and-mortar location shopping.

- Total US eCommerce retail sales up until the third quarter of 2023 were estimated at $1.8 trillion, highlighting a 2.3% increase from Q3 2022 results.

- The share of eCommerce sales in the third quarter of 2023 accounted for 15.6% out of all US retail sales, slightly less than the global average.

- 2023 maintains steady growth in US eCommerce revenue, estimated to reach $914.62 billion and $1.5 trillion by 2028 from consecutive annual increases.

- The number of US eCommerce users is projected to increase by 25% between 2023 and 2028, reaching a staggering 287.91 million digital shoppers.

- The percentage of US consumers participating in eCommerce has peaked at 74.73%. The buyer penetration rate will rise consecutively to 87.5% by 2028.

- Amazon is by far the largest US eCommerce platform, accounting for 37.6% of the retail market, with Walmart, Apple, and eBay contesting for 2nd place.

- US eCommerce consumers spent an average of $5,381 per person in 2023, which is expected to increase to $5,929 in 2024.

- The top-performing product categories in US eCommerce are clothing and footwear, followed closely by consumer electronics.

Chapter 2

B2B and B2C Sectors

In 2023, business-to-business eCommerce has increased in value and provides various new opportunities for integrated sales platforms and marketing channels.

The business-to-consumer sector prioritizes the customer shopping experience with more focus on social commerce and a wider range of eCommerce marketplaces.

B2B eCommerce Statistics

The business-to-business market is one of the largest sources of online revenue globally. The Asia Pacific region holds up the worldwide eCommerce industry with leading companies from the Alibaba Group, followed by North America and Europe.

- The global B2B eCommerce market has increased consistently throughout the years, reaching $24 trillion in sales, and is expected to increase to $36 trillion by 2026.

- Asia Pacific holds the largest share of B2B eCommerce, accounting for more than 78% of the B2B eCommerce market, with China leading by magnitudes.

- North America and Europe hold close to the remaining market share at 14.6% and 6.1%, respectively. However, the fastest-growing regions for B2B eCommerce are Latin America and the Middle East.

- Nearly 65% of all B2B businesses have adapted to reach the demand of the global eCommerce market and are more likely to offer online channels than in-person services.

- B2B content marketing is a growing driver for B2B purchase decisions, accounting for 18.8% of marketing consumption.

- The top three B2B marketplaces for generalist business services are Amazon Business at 36% user share, eBay (29%) and Alibaba (27%).

- 53% of B2B marketers use automation for their advertising services, and 91% consider the practice very important for marketing success.

- B2B marketers who use social media for social selling reach 45% more sales opportunities, 78% of whom outsell peers with a low social selling index.

B2C eCommerce Statistics

The business-to-consumer sector has increased its share globally, prioritizing tailored personalization, a focus on quality customer support, and online marketing automation. Expect more regions to grow their B2C eCommerce capabilities in the coming years.

- The B2C eCommerce market has reached $6.5 trillion in sales in 2023 and is expected to continue increasing to $8.3 trillion by 2026 at a 9.1% CAGR.

- China is the largest B2C eCommerce market by region, accounting for 52% of eCommerce sales, followed distantly by the US (19%) and the UK (4.8%).

- In terms of eCommerce retail growth, regions to look out for in the B2C sector are India and Brazil, growing at a CAGR of 14.11% and 14.07%, respectively.

- B2C US marketplace sales remain steady in the short term and positive in the long term, accounting for $1.7 trillion in 2023 market value, with nearly 60% of sales generated by third-party sellers.

- The global top-ranking B2C retail websites are led by Amazon, with 3.16 billion monthly visitors in 2022, followed by eBay, Walmart, Aliexpress, and Etsy.

- Out of all B2C market segments, online fashion retail is adapting to eCommerce purchases at the highest rate, forecasted to reach $1 trillion in revenue by 2028.

- 80% of businesses consider that marketing personalization is a key factor for increasing customer spending and 62% for customer retention, with a majority planning to invest more in digital personalization in 2023 and onwards.

- The rapid advancements of personalization software and generative AI are reflected by the massive growth of CX personalization revenue, from $1.16 billion in 2023 to around $5.16 billion expected by 2030.

Chapter 3

Shopping Cart Abandonment Stats

eCommerce businesses lose billions in revenue each year due to abandoned shopping carts. Reducing cart abandonment by optimizing website load speeds and simplifying checkout are great ways to increase online shopping orders on retail websites in 2024.

- In 2023, around 71% of all online shopping carts were left abandoned without finalizing a purchase.

- In the third quarter of 2023, US shopping cart abandonments have an even more significant rate of 85%, with the most pronounced results on mobile.

- eCommerce retailers lose a total product value of $4 trillion annually, but optimizing the online checkout process can recover as much as $260 billion.

- The three main reasons why potential customers abandon shopping carts are additional fees, relevant to 47% of respondents, mandatory account creation (25%), and slow delivery (24%), followed by a general lack of trust and a complicated or unclear checkout process.

- Of all devices, mobile cart abandonment rates are the highest at 85.65%, even though mobile usage accounts for the majority of all eCommerce sessions.

- Slow website load speeds increase cart abandonment by 70%, which results in a 50% decrease in overall customer loyalty.

- Cart abandonment is inevitable but can fluctuate – the lowest cart abandonment rates occur during November and December when customers prepare for the holidays.

Chapter 4

Shopper Behavior Statistics

Customers value convenience above all else when shopping online, both on their social media platforms and online marketplaces. Online shopper statistics help show where customers find new products to buy and what influences online purchase decisions.

- Public marketplaces are the primary online channels used to search for products, with private in-store websites coming in second place at 18%.

- 60% of shoppers start their buyer’s journey online, either researching product features and comparing pricing or making a purchase.

- Online reviews influence buyer decisions, helping consumers shop online with more credibility, with over 90% relying on social proof for brand loyalty.

- 36% of consumers have said that their most purchased product category online is clothing, which they would rather buy digitally than in-store.

- The top factor influencing brand loyalty for 80% of customers is having a large range of product options available in the store catalog.

- The second driving influence for online purchases is direct-to-home delivery, with 55% of consumers prioritizing the convenience of at-home shipping.

- Cross-referencing prices online is a large part of product research, listed as the main advantage of online shopping by 80% of Gen Z customers.

- In 2022, influencer recommendations became one of the most important factors for making a purchase decision for 30% of consumers, with recommendations from family and friends only accounting for 27%.

Chapter 5

Mobile Commerce Statistics

The fastest eCommerce growth rate and global eCommerce sales increase wouldn’t exist without mobile sites and mobile optimization. With a total of 4.32 billion mobile internet users, the vast majority of all internet traffic is accessed via mobile devices.

- The 2023 mobile eCommerce industry reached a market value of $2.2 trillion in sales, which is expected to rise to $3.4 trillion by 2027.

- Online mobile user sessions make up a total share of nearly 60% of all online traffic in 2023, continuing to hover above a 50% majority since late 2019.

- Mobile device usage accounts for 74% of the total share of eCommerce traffic across all devices globally, generating 63% of customer purchase orders.

- Mobile transactions generate 6.5% of the total share of retail sales globally, which is expected to increase to 8.7% by 2026.

- The highest number of mobile internet users by region is in Bahrain, UAE, and Kuwait, hovering over 95% of the population. In contrast, G7 countries have an average online mobile user base of 86%.

- Even when shopping in a physical store, 56% of customers use their mobile device in-store to research or buy products through an online sales channel.

- Mobile devices have higher traffic but less sales potential. eCommerce conversion rates on desktop were higher than mobile in 2022, at 3% vs 2%.

- Mobile optimization has yet to reach its full potential – the average bounce rate for mobile users after viewing only the first page of a website stands at 71.8%.

Chapter 6

Social Commerce Statistics

Social media platforms are one of the most significant drivers for retail eCommerce sales, especially for mobile shopping. Expect more sales and marketing efforts from integrated sales channels like Meta for Business, Pinterest, TikTok Shop, and others.

- Social media has captured the majority of the public interest, with 4.9 billion people using social media, or more than half of the global population.

- Social commerce sales have generated about $728 billion in eCommerce revenue, with an expected CAGR of 31.6% for the 2023-2030 forecast period.

- The number of social commerce buyers has grown steadily to 106.8 million in 2023 and is projected to continue rising to 118.1 million by 2027.

- Sales per each social buyer are expected to double to $1,224 on average in 2027 from an estimated $628 in 2023.

- The most likely top social media platforms for social commerce that users look to buy from are Facebook and Instagram, followed by YouTube in third place.

- Gen Z consumers have the largest social media presence, about 50% of whom have made a purchase online, compared to 38% out of all adults on average.

- 46% of Gen X and 24% of Baby Boomers are warming up to the idea of using social media for product discoverability, a 10% and 41% increase from 2022.

- A staggering 85% of Gen Z shoppers state that social media influences purchase decisions, naming TikTok and Instagram as prime research channels.

Chapter 7

Email Marketing Statistics

Despite the influence of mobile devices and social media for delegating and advertising products, email marketing is still a significant tool for increasing sales and promoting customer retention. In 2024, automation will help improve email marketing even further.

- Email marketing revenue is projected at $12.3 billion in 2024. At a growth rate of 13.3%, the total amount globally is expected to reach $17.9 billion by 2027.

- The number of email users is set to grow at a steady pace, from 4.26 billion in 2022 to 4.73 billion projected for 2026.

- One-half of all email marketers and developers in 2022 reported double the increase in their return on investment from email marketing campaigns.

- The average email open rate for eCommerce post-purchase messaging, marketing, and newsletters rests at 15.6%

- The advancement of automation software has persuaded 63% of marketing decision-makers to pursue email and social media management automation.

- In the US, 27% of users highlighted the effectiveness of email newsletters to influence their purchase decisions, while 24% stated that it had little to no effect.

- Emails that tailor their subject lines for specific user segments or individuals experience a 42% increase in email open rates from personalization.

- 55% of email marketers stated that expanding the use of personalization in marketing efforts is a top priority to focus on following 2023.

Chapter 8

2023 eCommerce Trends

eCommerce statistics can help businesses decide how to respond to the global market, but it’s important to analyze specific eCommerce sales and marketing strategies. Let’s see what drives online shopping consumer behavior in the modern eCommerce space.

Here are some digital commerce facts, interesting eCommerce statistics, and growing trends from 2023 that you should consider adopting for your online store or business to enable higher online retail sales or optimized services online.

Personalization Continues to Drive Customer Engagement

Contemporary online shoppers are warming up to the idea that digital data sharing is a necessary step to match their interests more closely with what they’re browsing.

82%

of people are willing to share some type of personal data for a better user experience.

71%

of consumers expect some amount of tailoring from online retailers.

Practice a more individualized approach on a per-user basis.

Tailored messaging, navigation, targeted promotions, recommendations for related products, and post-purchase communication are driving personalization purchasing influences.

Social Commerce Enables Better Omnichannel Strategies

Making online purchases by selling through social media platforms is an excellent way to increase product discoverability and influence user engagement. Consider social commerce as an extension of influencer marketing, combining recommendations with direct checkout.

When targeting the younger demographic, you absolutely need social commerce.

Social commerce in the US is already preferred above eCommerce sales channels by 22% of customers. Top eCommerce platforms already provide seamless integrations with social media, like Shopify, or livestreaming opportunities, like eStreamly.

The top social media platforms with social commerce features include:

- Instagram Shop

- Facebook Shop

- YouTube Shopping

- Pinterest Merchant Program

- Snapchat Store

- TikTok Shop

Consumers Rely on Mobile eCommerce Capabilities

Mobile purchases have increased in their share of all eCommerce sales and won’t stop anytime soon. As a larger number of Gen Z’ers and Millennials hold more purchasing power, the number of digital wallets is expected to rise rapidly to 5.4 billion by 2028.

Mobile commerce accelerates the need for easy navigation and visual browsing.

Users often begin product research on mobile websites but end up finalizing checkout on a desktop. Prioritize intuitive mobile navigation by providing a checkout save feature, navigational links or buttons, above-the-fold search bars, and pinch-to-zoom images.

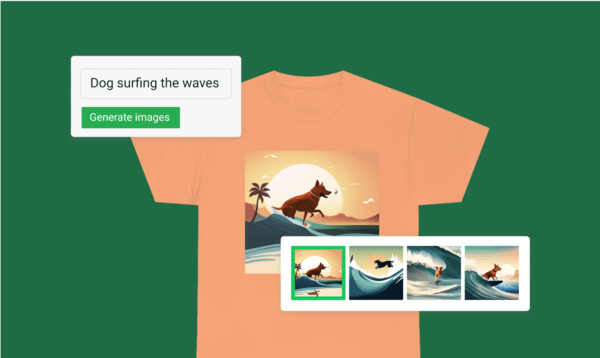

Marketing Automation Shifts to Generative AI Tools

With AI text tools like ChatGPT, image generators like Midjourney, and proprietary chatbots, the process of generating ideas and marketing copies has never been faster. Indeed, 90% of marketers who use AI find it highly effective for content creation.

Some of the software capabilities AI tools perform best are:

- content creation

- text optimization

- customer support

- inventory management

- idea generation

- marketing research

Generative AI is certainly multifaceted, with almost 60% of marketers using AI for product recommendations, 55% adopting AI eCommerce assistants, 52% constructing virtual models for product pages, and 51% creating AI personalized product bundles.

Positive Social Causes Reflect Sales Increases

Responsible consumerism and ethical consumption are priority concerns for many internet users. These are some of the only causes consumers accept against their own immediate benefit, with 80% willing to pay 5% more for eco-conscious production.

Sustainable fashion, eco-friendly packaging, and social causes take priority.

Customers engage with brands that align with public social stances and take a stand on public issues. As retailers continue driving engagement, they must also accept that customers want corporate social responsibility over ambiguous mission statements.

Subscription Models Enable Long-Term Customer Retention

Subscription-based eCommerce models and auto-renewal services have garnered a positive reception among consumers. The subscription eCommerce market size reached $120.02 billion in 2022 and is set to grow to $904.28 billion by 2026.

At a 64.64% CAGR, subscription eCommerce models have the fastest growth rate out of any eCommerce industry sector, providing steady revenue for online retailers.

Some of the most popular subscription-based industries are:

- ready-made meal services

- personal hygiene products

- themed merchandise bundles

- pet food, accessories, and supplies

- pharmaceutical supplements

Chapter 9

Holiday Statistics

Seasonal holidays have consistently increased eCommerce sales worldwide, especially in the fourth quarter from Thanksgiving to Christmas. 57% of US consumers planned to do holiday shopping online, maintaining pace during the last two years.

US retail eCommerce sales during the holiday season have an

11.3%

growth increase in 2023 from only 6% in 2022.

Mother’s and Father’s Day Statistics

Giving back to parents is a time-honored tradition and continues to show an increase in popularity with record-breaking global retail eCommerce sales. Breaking the hearts of every dad, Mother’s Day is celebrated by 88% of consumers compared to their 79%.

Regardless, both days resulted in a fair share of parental holiday spending, totaling $35.7 billion for Mother’s Day and $22.9 billion for Father’s Day in 2023. These times of year are especially important for online traffic involving men’s or women’s gift ideas.

4th of July Statistics

The all-American holiday is as strong as ever. With 87% of all citizens celebrating US Independence Day in 2023 – a 3% increase from the previous year – the total 4th of July spending grew by 23% to a daring $9.5 billion in 2023.

Still, don’t let the numbers confuse you. Americans and almost all consumers globally are more concerned about cost-saving due to the history of the 2020 pandemic, disruptions, and supply chain risks. Keep that in mind when adding prices and discounts.

Halloween Statistics

While key eCommerce industry statistics will inevitably center around the fall and year-end shopping season, there are multiple notable holidays that maintain consistent traffic and provide online business opportunities for brand advertising and sales deals.

In 2022, Halloween participation returned to pre-pandemic levels and is back on the rise. Total expected Halloween spending for 2023 has reached a record of $12.2 billion (one-third from costumes). Online purchases account for 32% of costume sales.

With 37% of people looking for Halloween inspiration online, this is the perfect holiday for content marketing, leveraging new costume trends and ideas to drive traffic from online shoppers via blogs, articles, multimedia, themed store pages, and more.

Cyber Monday and Black Friday eCommerce Stats

131 million US consumers plan to shop on Black Friday, with 11% of those participating having already bought from Black Friday deals at the start of November. Online stores should prepare their marketing strategy early to capture all digital buyers.

However, notably, the biggest eCommerce day is Cyber Monday, with $12.4 billion in total retail sales in 2023, reaching a 9.6% year-over-year increase. Culminating the end of holiday deals, customers expect the lowest possible discounts.

Black Friday and Cyber Monday eCommerce statistics insights by the numbers:

- Black Friday sales increased by 8% online in 2023.

- Cyber Monday sales increased by 5% online in 2023.

- 70% of Black Friday search queries occurred during October and the days leading up to the holiday weekend itself.

- 50% of consumers begin their holiday shopping in October or earlier.

- 33% of US holiday shoppers finish their holiday sales by mid-November.

- 26% off in discounts on average for electronics, toys, and apparel on Black Friday and 27% on Cyber Monday.

Christmas eCommerce Statistics

With 63% of people opting for online-only channels for Christmas holiday gift shopping, online shopping rates on eCommerce sites are slightly higher but still relatively on par with mass merchant and other brick-and-mortar store traffic.

As inflation rates continue to rise, customers are more price-conscious about spending habits than in previous years. The average amount that individual shoppers planned to spend for the holidays in 2023 is roughly $920, a slight decrease from $932 in 2022.

Christmas online commerce statistics, trends, and insights for 2023:

- Product categories leading sales for Christmas are apparel and gift cards.

- Over 80% of US consumers plan to visit Amazon for their Christmas shopping.

- 70% of consumers still have shopping plans the week before Christmas.

- 34% of online customers plan to use social media for potential gift ideas.

- 28% of US consumers use a buy-online-pickup-in-store holiday purchase.

Chapter 10

Print on Demand in 2023

From the increasing success of eCommerce in 2023, print-on-demand allows online shoppers to carve out their own online store in the global eCommerce market without struggling with large investments, inventory constraints, and product supply logistics.

State of POD

In 2023, print-on-demand software and service revenue reached a compound annual growth rate of 26.3%. Market value is expected to quintuple from $7.67 billion in 2023 to $38.21 billion by 2030, leading the online custom product segment worldwide.

The same report finds that in terms of market penetration, the largest POD region is in North America, while the fastest growth is expected from countries in Asia Pacific.

One of the main drivers of why more eCommerce business owners choose print-on-demand is the growing request for personalization. Another influence is sustainable production since the print-on-demand process limits large-batch manufacturing.

Print-on-demand eCommerce statistics, trends, and figures:

- The top print-on-demand product categories are apparel, home decor, and accessories.

- Profitable print-on-demand online shopping niches include pet products, online culture trends, social causes, family apparel, hobbies, and holiday items.

- Digital printing and screen printing hold the largest share in the print-on-demand fashion industry, with digital printing growing at 11.6% CAGR.

- The key drivers for the growth of print-on-demand are increased internet usage, variety of online shopping platforms, preference for personalization in the fashion industry, and the importance of waste reduction.

Chapter 11

The Best-Selling Printify Products (September 2023)

According to internal Printify sales data up to September 2023, here are the bestselling products currently offered and sold by print-on-demand retailers worldwide. The top selling product category is t-shirts at 52.38% order quantity, consistent year-over-year.

Product Name

% Of Item Quantity (Sold)

Unisex Jersey Short Sleeve Tee

19.22%

Unisex Heavy Cotton Tee

18.69%

Unisex Heavy Blend Crewneck Sweatshirt

9.65%

Unisex Garment-Dyed T-Shirt

5.62%

Unisex Soft-Style T-Shirt

4.79%

Unisex Heavy Blend Hooded Sweatshirt

2.87%

Kiss-Cut Stickers

2.35%

Unisex Ultra Cotton Tee

1.36%

Ceramic Mug 11oz

1.27%

Matte Vertical Posters

1.16%

Kids Heavy Cotton Tee

1.07%

Kiss-Cut Vinyl Decals

0.97%

Scented Soy Candle 9oz

0.96%

Youth Short Sleeve Tee

0.83%

Cotton Canvas Tote Bag

0.65%

Accented Coffee Mug 11oz

0.61%